SAFE Banking Act goes to the Senate

Why The Need for The SAFE Banking Act?

Although the legal marijuana industry has flourished over the last few years, there is one particular area that has proven challenging. With marijuana still classed as a Schedule I drug under the Controlled Substances Act, it is still a federal offense to take on any type of transaction with the substance. This is also the case in states where cannabis has been legalized for recreational use. This federal level statute has made it difficult for the financial sector to support or facilitate this industry, as they would be deemed to be abetting criminal activity.

Without access to some of the most basic banking services like deposits, withdraws and credit card transactions, marijuana businesses are forced to operate on a cash basis. That makes them particularly vulnerable to crimes like robbery. To help remedy this situation, a group consisting of lawmakers, financial sector representatives, and marijuana businesses have come together to push for the Secure and Fair Enforcement (SAFE) Banking Act.

This bill has been designed to permit financial institutions to cater to cannabis businesses without the fear of federal reprisals, in those states where cannabis has been legalized. The SAFE Banking Act is expected to help these businesses gain access to the same financial services as any other industry. These businesses are expected to operate safer with the reduced risk of being targeted by individuals with ill intentions. They will have access to insurance facilities and access to business loans to expand their operations. It also protects the banks from being prosecuted under money laundering laws that would arise out of dealing with cannabis-related businesses.

Who Will Influence the Senate Vote?

Reintroduced in April 2019 by a bipartisan alliance led by Democrat Sen. Jeff Merkley and Republican Sen. Cory Gardner, the bill managed to pass the House of Representatives in September 2019 with an impressive majority of 321-103. This bipartisan support was made up of 1 independent, 229 democrats, and 91 republicans. The bill has now moved to the republican controlled senate, where it waits to be voted on.

While the Senate is expected to be an uphill climb, there are some key players of special interest. The Senate Banking Committee chair, Idaho’s Sen. Mike Crapo has expressed a commitment towards seeing a cannabis banking bill on the Senate calendar before the year is out. While it is not entirely certain whether Crapo would actually support the passing of this bill, lobbyists view it as a positive step that some moves are being made towards finding a lasting solution.

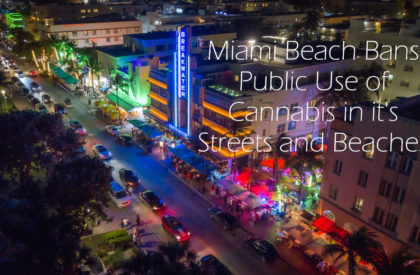

Related Article: Miami Beach Bans Public Use of Cannabis

Another important player would be the Senate Majority Leader, Kentucky’s Sen. Mitch McConnell. Though he has previously expressed disapproval for the cannabis business, he has worked to lift federal penalties on hemp production. Under the 2018 Farm Bill that he introduced, hemp was removed as a Schedule I drug and officially recognized as an ordinary agricultural product. Hemp is a strain of the cannabis family but has extremely low levels of the THC compound that is the psychoactive component.

Proponents of the SAFE Banking Act are hoping to persuade McConnell to their side by including measures in the bill that would similarly assist hemp businesses to gain better access to financial services. Kentucky was the biggest producer of hemp products before World War II, but this fell off in later years thanks to its criminalization as a narcotic. With the success of the Farm Bill, there has been an increase in acreage planted in 2019 that would mean more demand for financial services by growers, manufacturers, and distributors of the product.

Related Article: Napa Says No to Cannabis

Who Is Against the Bill

While the likes of McConnell are still considered wild cards that could go either way, several opposing groups are out rightly against the passing of this bill. Kevin Sabet, the CEO of Smart Approaches to Marijuana, is amongst those opposing this move stating that it is a backdoor that would see to the further marketing and promotion of cannabis.

For others, the challenge is not so much about the issue of cannabis and banking, but rather the federal criminalization. For the ACLU, the Center for American Progress, and congressmen like North Carolina’s Patrick McHenry, there is a belief that the focus should be on deciding on whether cannabis should remain a Schedule I substance. They feel that full federal legalization would do a better job of resolving all cannabis-related issues, than a partial solution on banking access. It remains to be seen just how much editing of the bill will be required to secure the senate vote, if at all.